-

Personal

-

Business

-

Rates

-

Resources

-

About us

We share our success with you

We share the success with you

- About us

- Profit sharing

More banking equals better banking

Get rewarded right where you’ll appreciate it the most. With DUCA’s Do More Profit Sharing program, the more you bank at DUCA, the more profit-share rewards you’ll earn and the better your everyday banking experience. Want a lower mortgage or loan rate? Done. Looking for a higher term rate? Yes! Or how about a simple cash conversion? Also, yes!

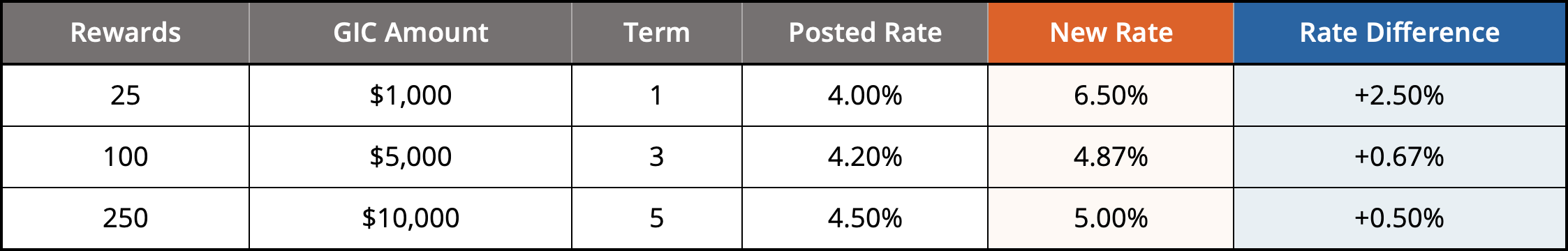

Increase Term or GIC Rate

Use profit-share rewards to earn up to a 10% increase on the posted interest rate for a term product.* Earn more on eligible registered and non-registered products.

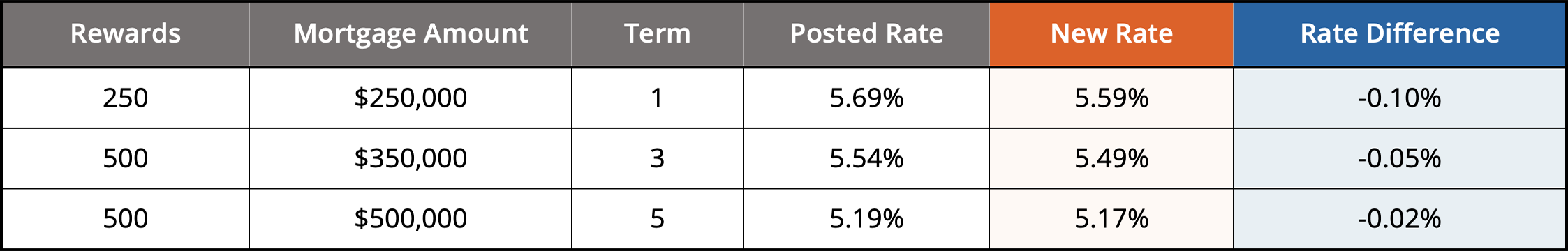

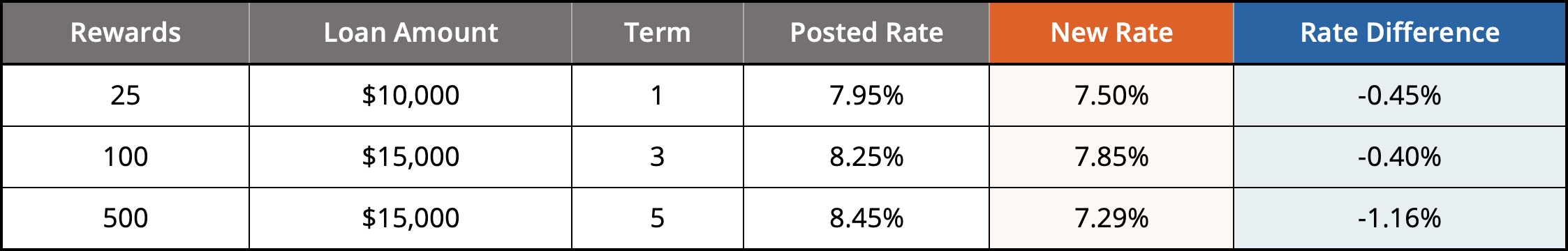

Reduce Mortgage or Loan Rate

Borrow money for less. Apply profit-share rewards towards a rate discount off the fixed mortgage or loan rate for which you qualify.*

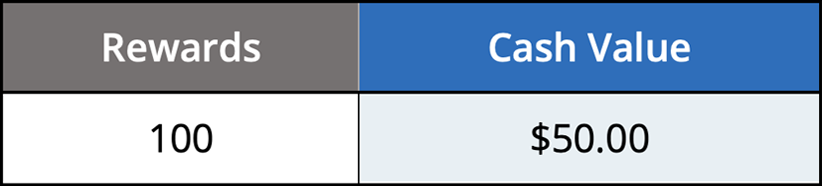

Convert to Cash

Just want the money? Convert profit-share rewards into cash at 50% of the face value. We’ll put the money right into your DUCA account.*

* Subject to your profit-share rewards account balance. Minimum required for redemption: 25 profit-share rewards

All you need to know

It’s a good day when your financial institution rewards you for your business by giving you more of the very thing you’re here for: Money. Whether it’s a better rate or cash, you end up with more money in your pocket just for banking at DUCA.

- Earn up to 1000 profit-share rewards per calendar year with no limit as to how much you could accumulate over time or use at a time.

- With just a minimum balance of 25 profit-share rewards required for redemption eligibility, you’re on your way to “buying” better rates or realizing a cash value.

- Easy to use: Visit a branch, call Member Connect, or – easiest of all – manage it all yourself at your desktop or laptop (not available yet on our mobile banking app) and send a redemption request through your online banking profile! If you don’t have an online profile, contact us to set one up.

- Flex rewards for non-registered products and registered rewards for registered products: Profit-share rewards are distinguished by their registered or non-registered status. Flex rewards are applied to non-registered redemptions (fixed mortgage or loan, GIC) and registered rewards are applied to registered redemptions (RRSP, RRIF, LIF, LIRA). Both flex and registered profit-share rewards can be used for a cash deposit!

The easiest way to track and use profit-share rewards is by doing it yourself through your online banking profile at your desktop or laptop*. Find your profit-share rewards history, check your balance, use the calculator to envision what you can purchase, and then submit your redemption request. Give us two business days to review your request and we’ll contact you to finalize or follow up, if necessary.

*Note: The Do More Profit Sharing information is not available on our mobile banking app at this time. Please manage your profit-share rewards account at your desktop or laptop.

Don’t have an online banking profile? Your annual profit-share rewards statement will be mailed to you if you receive paper statements. (And while those with an online account will be able to view their profit-share activity online at any time, their annual statement will be uploaded to their online e-documents.) To use your profit-share rewards, visit your branch or call us at 1.866.900.3822.

If you’re not signed up for the 24/7 convenience of online banking yet, now is a good time to contact Member Connect or your branch to sign up. Learn more about the benefits of online banking.

The following will help you visualize what it takes to earn and use profit-share rewards.

Earning Profit-Sharing Rewards

You’ll accumulate profit-share rewards based on the total amount of interest you pay as well as the interest you earn.

Examples: Let’s say …

- You pay $36,000 in mortgage interest in a year.

➜ Then you will earn 360 profit-share rewards! (At a sample 1% rate*) - You earned $400 in interest in a year on your GIC.

➜ Then you will earn 4 profit-share rewards! (At a sample 1% rate*) You’ll earn flex profit-share rewards for a non-registered GIC or registered profit-share rewards for a registered GIC.

Using Profit-Sharing Rewards

The chart below illustrates how to use profit-share rewards to buy up a better term rate or buy down a better mortgage or loan rate. It also shows the cash value of profit-share rewards.

Using profit-share rewards on borrowing (fixed mortgage or loan)—buying down the rate1

Cashing in your profit-share rewards—direct deposit1

* Rate of 1% is for illustration only. Rates are established on a yearly basis at the discretion of the Rewards Committee and are dependent upon Credit Union performance.

1 This chart is for illustration purposes only and is not the final authority on a Member’s profit-share rewards redemption. Final rates and cash values will be confirmed by DUCA, at DUCA’s discretion, and in accordance with the Terms and Conditions for the Do More Profit Sharing program.

Try this! See what you can do with your profit-share rewards by adjusting the sliders below to reflect the average yearly balance of your DUCA products in each category. Your profit-share rewards are determined by the amount of interest you either earned or paid by banking with DUCA.

If you have specific goals in mind, talk to one of our experts to see how accumulating profit-share rewards can help you reach your goals faster and keep more money in your pocket.

Cash redemptions are taxable: When applying profit-share rewards towards a cash redemption – whether from the flex profit-share rewards account or registered profit-share rewards account – a T5 or NR4 slip will be sent after the year’s end for all cash rewards valued at $50.00 and up.

Registered product redemption: When profit-share rewards are applied towards a registered product, the redemption itself does not trigger any sort of tax response. Tax implications depend on the product to which the profit-share rewards are applied.

Consult your tax advisor if you have any tax related questions about participation in our Do More Profit Sharing program.

Program Background and Member Eligibility

- Why has DUCA changed the Profit Sharing Program?

Since 1999, and prior to the Do More Profit Sharing program, DUCA shared profits with Members in the form of Class A Shares. Some Members found the Share program confusing and difficult to track. In addition, the redemption rules around Class A Shares were somewhat complex.

The new Do More Profit Sharing program simplifies the profit sharing process by making it easier to understand and visualize how to accumulate, use, and view the profit-share rewards DUCA grants to our most engaged Members for their business. There is no vesting period plus the program is more accessible to a Member. In short, Members will be able to more easily envision the profit-share rewards they'll earn for their business at DUCA plus gain greater control over how to apply them.

- Who is eligible for the Do More Profit Sharing program?

All DUCA Members, Personal and Business, in good standing with active accounts are eligible to earn profit-share rewards. When a Member qualifies for at least one profit-share reward (flex or registered) in a year, a profit-share rewards account will be opened automatically for the Member the next year.

- Are any Members excluded?

You must be a DUCA Member in good standing. Refer to our Terms and Conditions for full eligibility criteria.

- What are the Terms and Conditions for the Do More Profit Sharing program?

Read our full Terms and Conditions here.

- I’d like to talk to someone about the Do More Profit Sharing program and my profit-share rewards. Who can I contact?

Profit-Share Rewards

- What are the two types of profit-share rewards and how does a Member earn them?

Flex rewards: Savings accounts, GICs, term products, mortgages, loans, TFSAs and Wealth portfolio are eligible to earn flex profit-share rewards.

Registered rewards: All registered products are eligible for registered profit-share rewards.

- How are profit-share rewards distributed, considering the maximum allowable profit-share rewards a Member can receive is a combined (flex and registered) 1000 profit-share rewards per calendar year?

Flex profit-share rewards will be distributed before registered profit-share rewards. When a Member earns both flex and registered profit-share rewards in a year, the flex rewards will be allocated first to the Member’s flex profit-share rewards account. Next, earned registered rewards will be allocated to the registered profit-share rewards account. Since the maximum allowable combined allocation in one year is 1000 profit-share rewards, anything over 1000 will not be allocated. Please see example below.

Member earns: 600 flex profit-share rewards + 450 registered profit-share rewards = 1050 total profit-share rewards

Allocation: 600 profit-share flex rewards + 400 registered profit-share rewards = Total allocation of 1000 profit-share rewards which is the maximum allowable allocation

The following year, Members are eligible again to earn up to an annual combined maximum of 1000 profit-share rewards.

- How does DUCA determine the number of profit-share rewards earned by a Member?

The profit sharing rate will be set annually at the sole discretion of DUCA’s Rewards Committee and is dependent on Credit Union performance.

- How are profit-share rewards allocated when an account is held jointly?

When an account is held jointly, earned profit-share rewards are split between the two Members: One Member receives half the earned profit-share rewards into an individual profit-share rewards account and the other Member receives the other half into that Member's individual profit-share rewards account. (See next section "Redemption" for information on combining profit-share rewards for a joint redemption.)

- Will Members be charged for the opening of the new profit-share rewards accounts?

No. The profit-share rewards account opening will be handled automatically.

Redemption

- What is the value of rewards at redemption?

Profit-share rewards are applied at 100% of their value when applying them towards a higher GIC rate or a lower rate on a lending product. Profit-share rewards, both registered and flex, are applied at 50% of their profit-share reward value when applied towards cash.

- Is there a minimum profit-share reward balance required prior to submitting a request for redemption:

Yes. A Member must have a minimum of 25 flex profit-share rewards to submit a request for an increased non-registered GIC rate or for a decreased fixed loan or mortgage rate and 25 registered profit-share rewards to submit a request for an increased registered product rate.

A Member must have a minimum of 25 profit-share rewards to submit a request for a cash redemption.

- How can a Member notify DUCA about using their profit-share rewards?

The easiest method is for the Member to submit a request to use their profit-share rewards while logged in to the Member’s online banking profile. This function is not available on our mobile banking app at this time. Alternatively, a Member may contact a branch or Member Connect.

- After a Member submits an online request, what happens next?

Please give DUCA three business days to respond to a redemption request. DUCA may reach out to you by phone or email prior to processing if we require additional information. A straightforward request for cash will appear as a deposit.

- Can profit-share rewards be combined in any way?

Only in instances of a request for cash. When requesting a cash redemption, flex and registered profit-share rewards may be combined to equal a total of at least 25 profit-share rewards in order to be eligible for redemption.

- What happens if a Member wants to cash in some profit-share rewards by using a combination of both flex and registered profit-share rewards?

In cases where a Member has both types of profit-share reward accounts, and wishes to cash out a portion, rewards will be taken first from the flex rewards profit-share account. If there is any leftover balance required to completely fulfill the redemption request, it will be taken from the registered profit-share reward account.

- Can profit-share rewards be redeemed for a joint product?

Members may choose to combine their profit-share rewards, if they wish, to apply them to a product that will be held jointly. When combining profit-share rewards for a joint redemption, each Member’s profit-share rewards account is subject to the 25 profit-share rewards minimum in order to be eligible for redemption. (See previous section "Profit-Share Rewards" for information on earning profit-share rewards from a joint account.)

- Are profit-share rewards transferrable?

No. You cannot sell, barter, transfer, use as security or collateral, or assign your Do More Profit Sharing profit-share rewards to another DUCA Member.

- Can a Member use profit-share rewards early (before the yearly distribution) and have the profit-share rewards prorated, i.e., prior to the award date?

No. Profit-share rewards cannot be used in advance of the award date nor will they be prorated.

- Will profit-share rewards ever expire?

Do More Profit Sharing rewards will not expire and or be forfeited so long as the Account associated with the program remains open, active and in good standing, and the profit-sharing rewards program is still ongoing. Please refer to our Terms & conditions for more information.

General

- Are Wealth portfolios included in a Member’s eligibility for profit-share rewards?

Yes, as of January 2023, wealth portfolios are eligible for earning profit-share rewards.

- What happens if a Member leaves DUCA?

A Member can choose to have profit-share rewards converted to cash prior to leaving DUCA. If a Member’s membership is terminated according to DUCA’s Membership rules (see our Terms and Conditions here), profit-share rewards will be forfeited.

- Can a Member opt out of the Do More Profit Sharing program?

Yes. Contact DUCA directly to opt out at either 416-223-3828 or profitsharing@duca.com.

- Can a designated Power of Attorney redeem profit-share rewards on behalf of a Member?

Yes.

- Can an estate account hold profit-share rewards?

Yes. In the event of death, Do More Profit Sharing rewards can be transferred to the Estate of the deceased or to a nominee. The options for the Estate executor are: To continue to hold the profit-share rewards balance under the Estate account, convert to cash, or forfeit the remaining profit-share rewards.

- How does the new Do More Profit Sharing program affect Members who currently hold Class A Shares? (From the previous Profit Sharing program)

DUCA will not be issuing new Class A shares as we have transitioned to the new Do More Profit Sharing program.

Decisions about paying dividends on existing Class A shares will continue to be determined by the Board of Directors each year, as per the current policy regarding Class A shares and dividends.

There is no change to the redemption process for existing Class A shares. Members may redeem their Class A Shares according to the Class A share redemption policy.

Existing Class A shares do not roll into the Do More Profit Sharing Program.

For questions about the program

Call 416-223-3828 or email profitsharing@duca.com

View Terms and Conditions here.

|

|

|---|---|

|

|

Need help?

Call Member Connect

Email us

Find us

Need help?

Call Member Connect

Email us

Find us

Working to not only be the best in the world, but also be the best for the world.

|

|

|---|---|

|

|

Eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through the Financial Services Regulatory Authority. Visit FSRA.

FSRA Deposit Insurance Brochure